Part 4: Brands Want Their Piece of the Resale Pie

Part 4 of our 10-part series breaking down each of the major stakeholders in the resale industry and how all the pieces come together.

Here’s where we’re at:

Introduction: A roadmap of the resale industry

Part 1: Thrift and Consignment Stores

Part 2: Online Resale Marketplaces

Part 3: The rise of full-time Resellers

Part 4: Brands Getting Into Resale ← this post

Part 5: Resale As A Service Companies

Part 6: Textile Recycling Facilities

Part 7: Fashion Designers

Part 8: Stylists

Part 9: The Role of the Customer

Part 10: Predictions for the Future — What comes next

?

Some of the newest entrants into the secondhand industry are fashion brands. While it may seem counterintuitive that brands designing and producing new clothes would want to get into the secondhand side of the business, that's exactly what many brands are doing. After watching the resale boom from the sidelines, many brands are wanting to take advantage of the growing interest in secondhand themselves. After all, ThredUp estimates that the global secondhand market will almost double, reaching $350 billion by 2027.

The Business Model

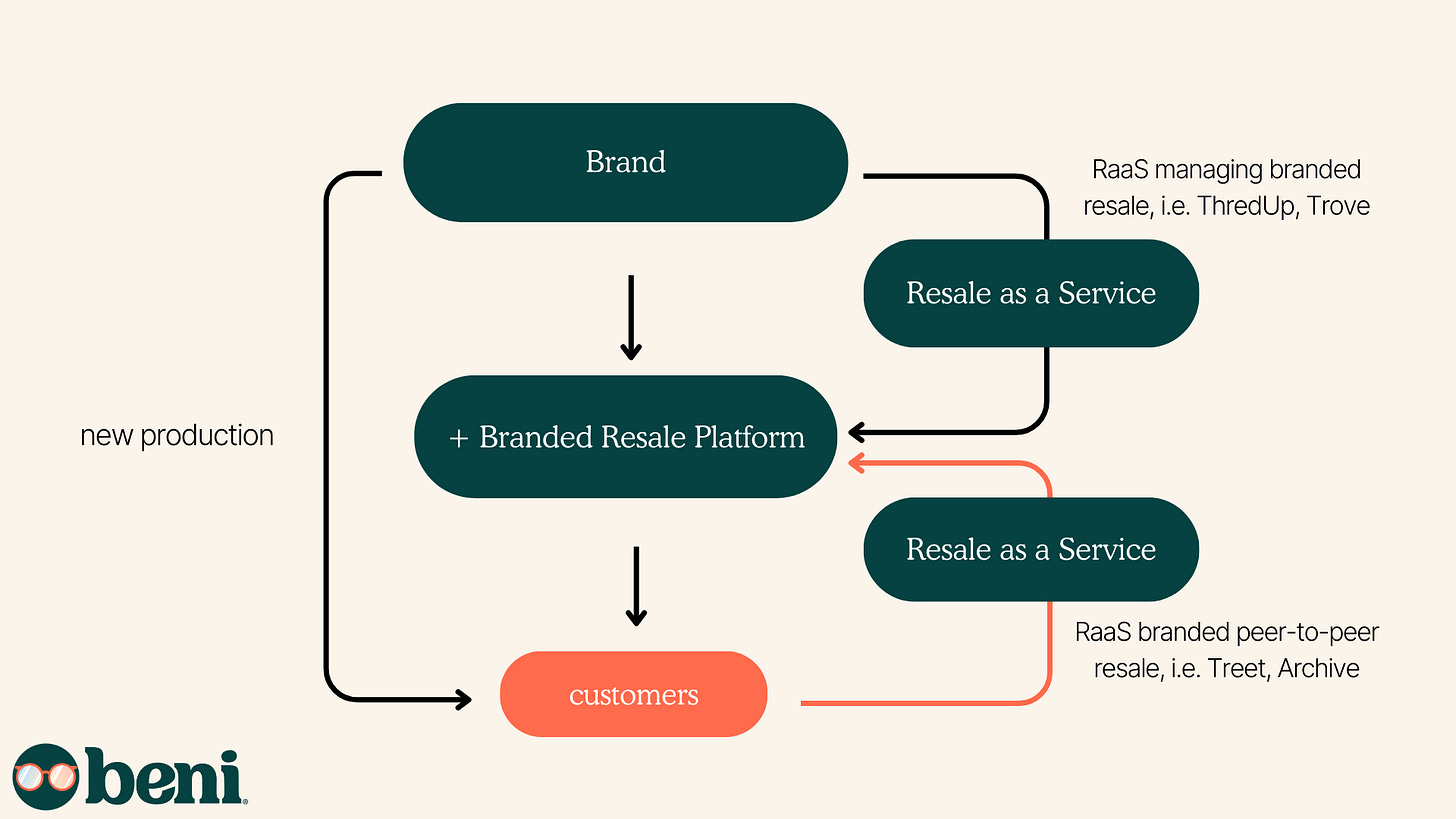

Brands entering the world of secondhand are adding on resale as another arm of their business. Many brands are using resale as a tenet of their brands' “circular strategy” or sustainability initiatives. To do so, they are partnering with other businesses to integrate and offer a secondhand selling channel. These partner businesses are known as Resale as a Service (RaaS) companies and they offer either managed or peer-to-peer resale models. By outsourcing secondhand selling to a third-party to manage their resale platform, brands don't have to learn and establish an entirely new business model on top of what they're already doing.

For most brands integrating resale, shoppers will be able to access the pre-loved offerings from a tab on the brand's website which will redirect to the RaaS-hosted secondhand storefront. The secondhand inventory is populated by items that the brand receives through a take-back program in which previous customers send in their old clothes to the brand with which the brand will pass on to the RaaS provider to sort and manage the re-selling. Alternatively, the resale model may use a peer-to-peer model in which customers can list and sell their items themselves through the branded RaaS platform. Customers may be incentivized to participate with discounts, shopping credits, or actual cash for their items.

Industry Role

Brands getting into resale means that secondhand experiences can be more tailored and focused and offers yet another way for customers to engage with pre-loved clothing. This expands the audience of potential secondhand shoppers. Branded resale further reduces secondhand stigma and can increase the customer's trust in what they are getting because of the filter of going through the brand.

It also has clearly opened doors for new business models like RaaS to exist and serve the industry. While some RaaS businesses existed before brands were as open to adding branded resale as they are now, many have launched in just the past couple years. New brands and RaaS companies rely on each other to accomplish their aligned goals of creating more cashflow through resale outlets.

Given the excess that overflows in thrift stores, branded resale isn't inherently a threat to other secondhand models. Arguably, it even offers an alleviation of the burden of secondhand selling if some of it is naturally diverted through these branded programs. Branded resale does increase the brand's extended producer responsibility by taking accountability for more of the product’s life through offering pathways for products after they are used by the consumer.

The brand and its RaaS partners are then managing the disposal process for the customer which also includes relocating unsellable inventory to other end-of-life models like recycling. This allows for these other disposal methods to be engaged with at a greater scale than if the customer were just recycling or donating themselves. Ideally, this is increasing the likelihood these items are diverted from landfill.

Major Players

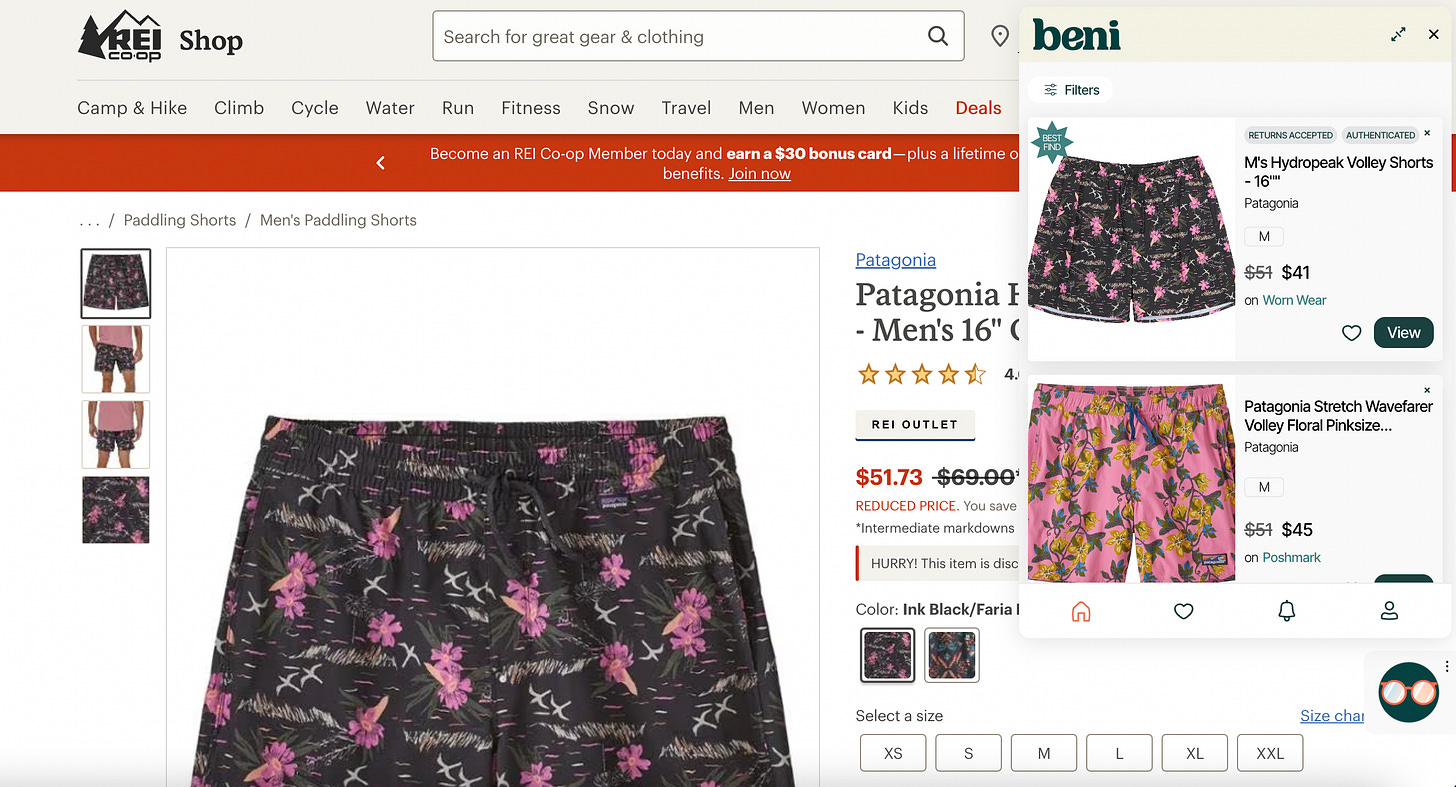

Unsurprisingly, more sustainably-minded brands were some of the first to integrate resale into their model. Eileen Fisher got involved in branded resale with its Renew program which first was available for employees to bring in old clothes in 2009 and then made available to all customers in 2013. Patagonia launched its resale program Worn Wear in 2017. According to ThredUP, Athleta, Tea Collection, and J.Crew dominate branded resale in terms of how many listings are available for sale. Secondhand appeals to brands from every facet of the industry from big fast fashion brands like H&M and Pretty Little Thing to more premium brands like Hugo Boss and Mara Hoffman who have all ventured into the world of resale.

PARTNER SPOTLIGHT: PATAGONIA WORN WEAR

Patagonia was the first brand to partner directly with Beni! That means if you’re shopping for Patagonia anywhere on the internet, Beni will show you if what you’re looking for is already on Patagonia’s resale site and link you right to it!

Opportunities & Challenges

Adding resale allows brands to capture more customers. For higher-end brands, they can serve a customer they wouldn't have been able to otherwise thanks to the lower cost barriers to secondhand. Then, they are inviting that customer into the brand ecosystem and experience where they may be able to buy new at a higher price point down the road. Ultimately, resale models drive revenue for the brand and increase the customer's loyalty to the brand.

One of the biggest opportunities for brands getting into resale is to curb their environmental footprint and engage in more circular practices. We've all heard the woes and warnings of fashion's overproduction problem with clothes piling up in landfills. There's never been a better, more necessary time to cut back on new production. Adding resale into a brand's business model allows them to keep expanding and growing without having to make as much new product. Unfortunately, we haven't yet seen evidence that brands are using resale to lessen new production, but that is ultimately how brands can be and should be integrating it if they want to incorporate it to the highest level of sustainable benefit.

Incorporating resale models could also incentivize brands to design with resale in mind. This would look like designing with a longterm outlook, upgrading the quality, and considering more timeless styles that would be appealing in years to come as they enter the secondhand market. This comes with environmental benefit but also allows the brand to capture the value of their product better on the back end because the product actually has the longevity to still indeed have resale potential.

Of course, a major challenge for brands is having the capacity and infrastructure to incorporate resale, especially at scale given the added complexities of secondhand selling, which is where RaaS businesses come in.

Tune in next week as we delve into Resale as a Service businesses that help eradicate the barriers for brands to step into the resale industry.

QUESTION FOR THE GROUP:

How do you think brands will approach the marketing aspect of their resale services?